Supply Chain Finance / Working Capital Finance

Comprehensive financial solutions tailored to your business needs

Our Service Offerings

At AK Capital Advisors, we understand that liquidity is the lifeline of any business. Timely access to working capital ensures smooth operations, growth, and stronger relationships with suppliers and buyers. Our Supply Chain & Working Capital Finance solutions are designed to optimize cash flows, unlock capital tied in receivables, and provide seamless financing across the entire value chain. We bridge the gap between businesses, suppliers, buyers, and financial institutions— creating efficient financing structures that enhance both liquidity and profitability.

Cash Credit (CC) & Overdraft (OD) Facilities

Cash Credit (CC) & Overdraft (OD) Facilities

Cash Credit & Overdraft Options

Flexible working capital facilities that allow businesses to draw funds as needed against security or credit limits.

- Inventory & Receivables Backed CC

- Secured & Unsecured Overdraft

- Drop-Line & Ad-hoc Overdraft Facilities

- Working Capital Demand Loans (WCDL)

Bill Discounting / Invoice Discounting

Bill Discounting / Invoice Discounting

Discounting Solutions

Short-term credit facilities that allow businesses to receive immediate funds by discounting purchase or sales bills with financial institutions.

- Purchase Bill Discounting

- Sales Bill Discounting

- Bill Discounting

Discounting Solutions

Short-term credit facilities that allow businesses to receive immediate funds by discounting purchase or sales bills with financial institutions.

- Factoring

- Reverse Factoring (Buyer-Led Financing)

- Export Bill Discounting

Letter of Credit (LC) & Bank Guarantees (BG)

Letter of Credit (LC) & Bank Guarantees (BG)

Letter of Credit (LC)

A bank undertaking that ensures payment to exporters on behalf of importers, reducing counterparty risk in trade finance.

- Import Letter of Credit

- Export Letter of Credit

- Sight Letter of Credit

- Usance (Deferred) Letter of Credit

- Standby Letter of Credit (SBLC)

- Revolving Letter of Credit

Bank Guarantees (BG)

A commitment from the bank guaranteeing the financial or performance obligations of a client to a beneficiary.

- Financial Guarantee

- Performance Guarantee

- Bid Bond / Tender Guarantee

- Advance Payment Guarantee

- Deferred Payment Guarantee

- Foreign Bank Guarantee

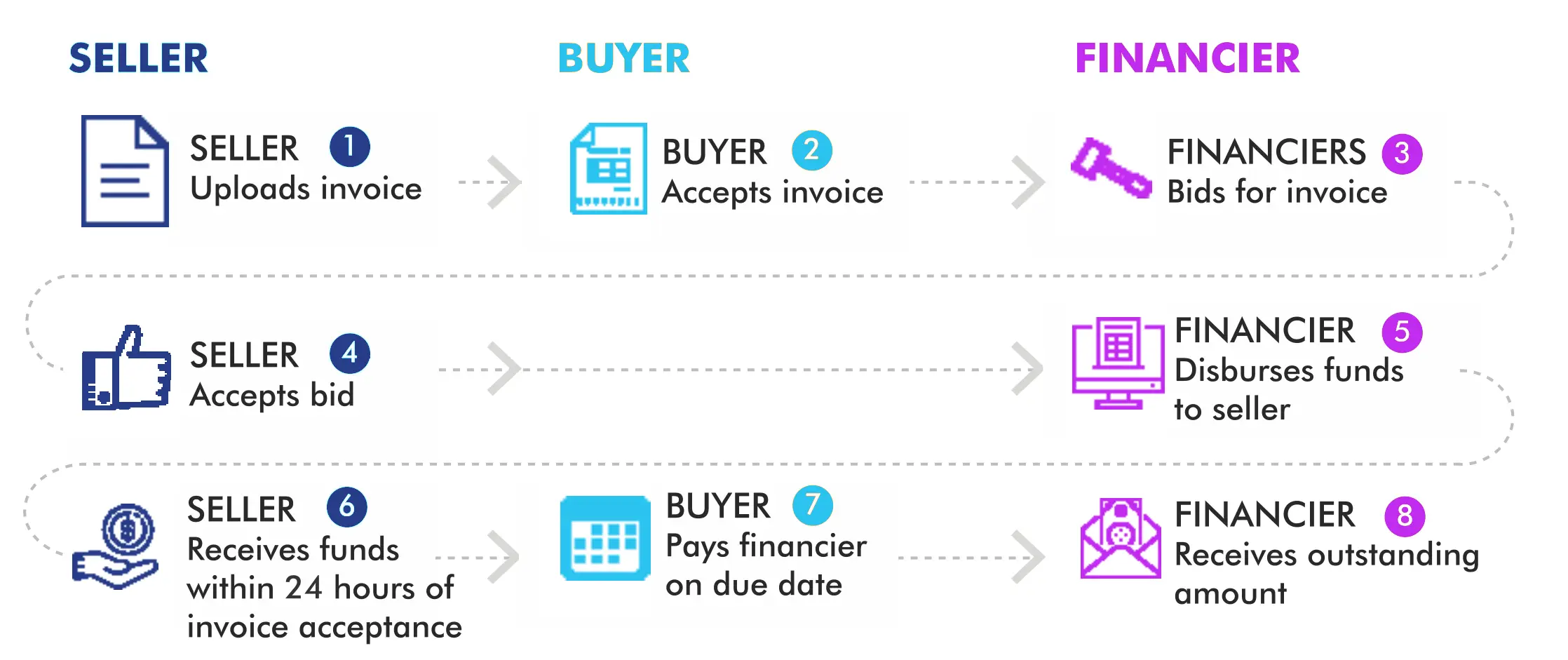

How Factoring Works

How Factoring Works

Factoring

A factoring transaction begins when a seller uploads an invoice on the platform and creates a Factoring Unit (FU). An FU contains necessary details of the invoice in digital format and must be accepted by the buyer before it is sent to financiers for bidding. The seller then chooses the most suitable bid and receives funds from the financier within 24 hours. On the due date of payment, the buyer pays the outstanding amount to the financier. In factoring, the credit is extended to the Supplier based on the buyer’s creditworthiness which means the supplier can enjoy low cost of funds, which are extended to large corporate buyers, because of their credit rating.

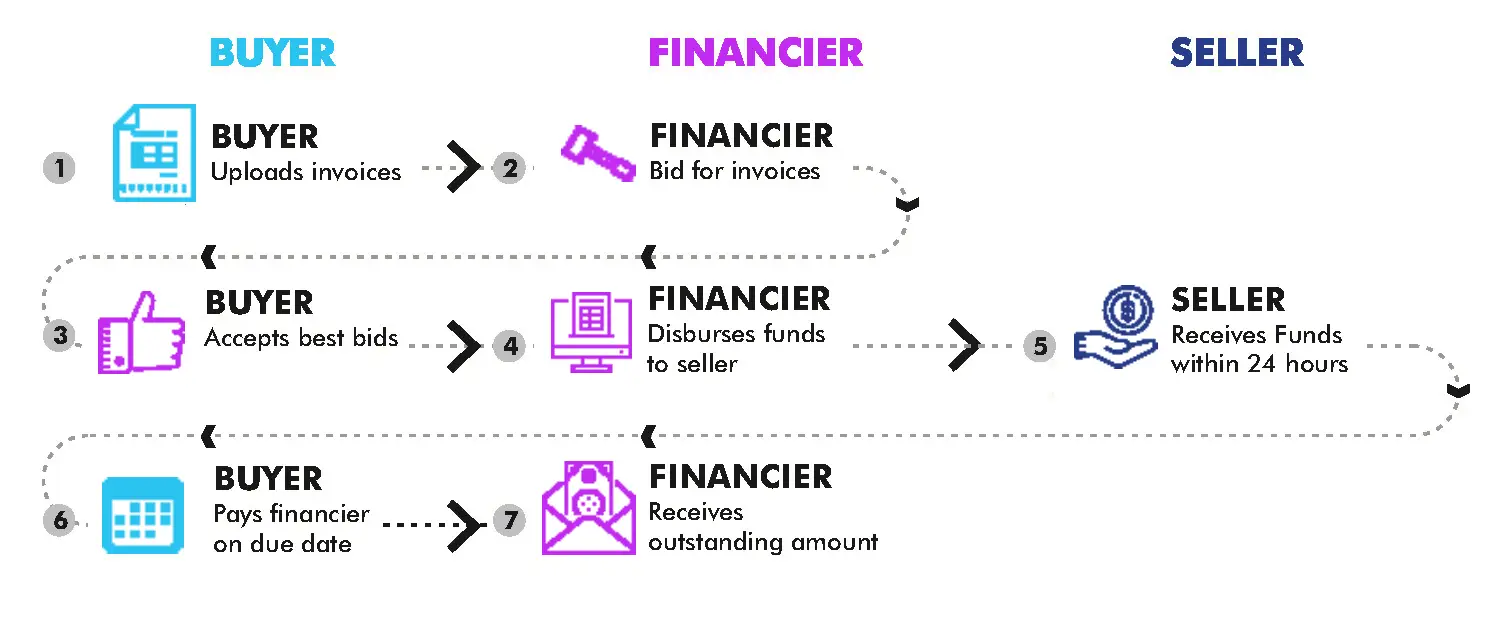

Reverse Factoring

A Reverse Factoring transaction begins when a buyer uploads an invoice on the platform, on behalf of the seller and creates a Factoring Unit (FU). An FU contains necessary details of the invoice in digital format which is sent to financiers for bidding. The buyer then chooses the most suitable bid. The Seller receives funds from the financier within 24 hours. On the due date of payment, the buyer pays the outstanding amount to the Financier. Factoring (or reverse factoring) is not a loan and differs from traditional bank credit. It is a true sale of an asset (invoice in this case) and does not create a liability on the balance sheet. Unlike a bank credit which involves two parties, factoring involves three parties – the seller, the buyer and the factor or the financier. The credit decision is based on the creditworthiness of the buyer, instead of the MSME seller.

Ready to get started?

Contact our experts today to discuss how our financial solutions can help your business thrive.